JEA Bill Pay Options

A community member using JEA services has a lot of payment medium available through which they can pay their JEA electric bills. JEA makes sure that is always striving for providing its customer the best features and services. If you are a customer of JEA, you can choose among the following option that is most convenient for you in paying your bills – Bill payment by Phone, Bill payment online, Bill payment by mail, Bill payment in-person and Bill payment through Ez pay plan.

Bill payment by Phone: Customers can now pay their JEA bill through phone by using third party payment service provider Bill2Pay. You will need to call on 1-904-665-6000, where a Bill2Pay team member will guide you in paying your bill through your Credit / Debit cards or through your Savings / Checking bank account. Bill2pay charges a processing fee of $4.95 from customers of JEA for payment of bills.

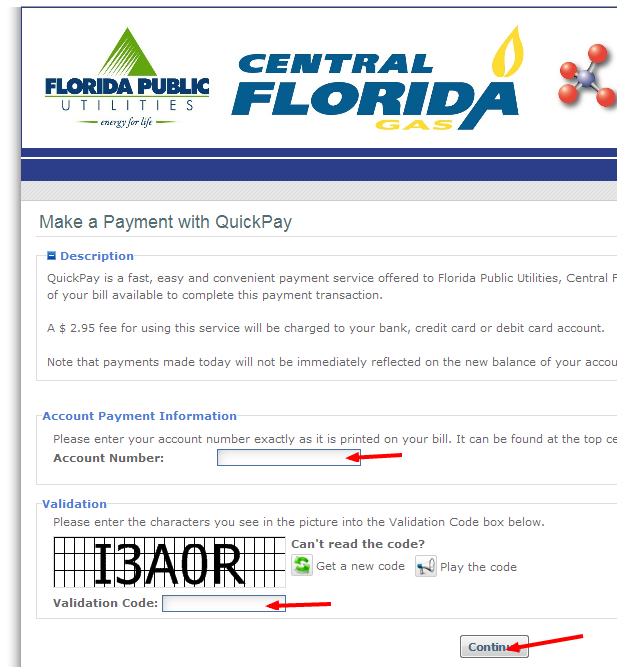

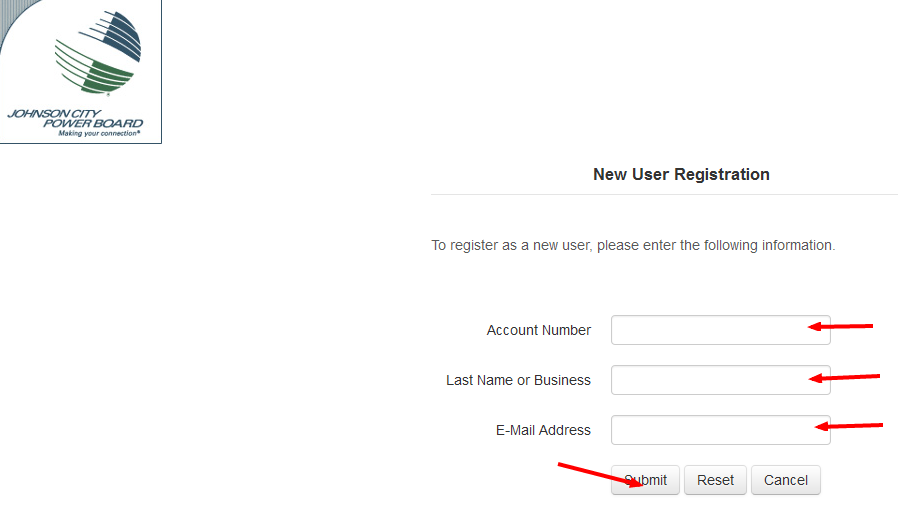

Bill payment Online: JEA customers can pay their electric bills online by visiting the website of JEA www.jea.com or by directly visiting the page https://jea.com/Registration.aspx?ReturnUrl=/obp/. You will need to go through registration process, which will require you to furnish you JEA electric account details along with you Email ID.

A Verification mail is sent to your mail ID to verify your account. After verification, you can log in to your account and pay your e-Bill by using your credit card, Debit card, Savings account or Checking account.

Bill payment by mail: When you receive your paper bill from JEA each month they also send a self addressed return envelope to be used in paying the bill through mail. You can send your check or money order along with your Bill stub in this envelope. You can also send the bill payments directly to –

JEA

Post Office Box no. 45047,

FL 32232-5047.

Bill payment In-person: JEA has three offices where you can pay your Electric bill in-person by cash or check. The addresses are

1) Highlands Square, 1108 Dunn Ave., Jacksonville.

2) Customer Business Office, 21 West Church St., Jacksonvilleand.

3) St. Johns Square, 11140 Beach Blvd., Jacksonville.

Bill payment through Ez pay plan: You can auto pay your JEA electric bills by registering for the Ez pay plan. Every JEA office has the details and forms available for applying to Ez pay plan. After your application has been processes, your electric bill will be auto deducted from your bank account or your credit / Debit card each month.